Navigating Numbers: Cost Control and Budget for Construction

In any business, expense control is a critical aspect. Expense control is the key to healthy financial status for a company.

by Sheldon Huang

|

The construction industry is one of the most common to go over budget. In the construction industry, some contractors have reported projects “going up to 80% over budget.”

Moreover, one of the most severe crises the industry is going through is the rise of raw material prices. The average material cost has increased by 19%, according to Gordian, and “82.5% of construction materials… experienced a significant cost increase.” On top of material prices, worldwide labor shortage is leading to increased labor costs.

Under these harsh conditions, construction companies need to be more careful when handling finances.

Over the long term, it is best if construction companies have a thought-out financial plan. Having a bottom line and a profit margin allows contractors and business owners to know the status of the business.

First Step: Have a Budget

Basics of Forming a Budget

The foundation to cost controlling is establishing a business budget.

When allocating a budget, there are numerous aspects to keep track to compose an effective budget plan. The foremost is the company’s goals and the company’s capabilities.

Financial managers should be familiar with the two aspects to find the balance between spending and profiting. Under-allocating the budget may hinder the team’s ability to work efficiently. On the other hand, over-allocating the budget will waste unnecessary resources and harm future projects.

After completing a budget plan, dissemination is also key to keeping the plan effective. Other than management, the rest of the team should also be aware of the budget. Having every member be aware of the budget helps everyone work accordingly. Establishing a cost estimate or a project cost also lets the team know what to expect.

Once the team starts the project, the team should focus on preventing the spending from growing over budget. If the budget doesn’t contain mistakes, each component should be obtainable within budget.

Circumstances where cost overrun is unavoidable is especially common with construction budgets. Even then, the team should keep the extra spending as low as possible.

Styles of Budget

For different needs and business models, there are actually different ways a company can form a budget. Different styles of budget plans suit different companies according to demand. Here are some of the more common budget styles:

1. Activity-based Budgeting

Activity-based Budgeting is when businesses create their budget based on their goals for the project.

The finance team looks at the expected profit first, before anything else. Then look at the required amount of work that will generate those outcomes, and formulate a budget based on the amount of work.

2. Zero-based Budgeting

Zero-based budgeting requires more effort, but can be more helpful to businesses.

Zero-based budgeting allocates budget only when the cause is necessary. “Default spendings” do not exist in this budgeting style. This means the company re-inspects the business every year, and every cause of the budget must be justifiable.

For Small and medium-sized enterprises (SMEs), this is the optimal way to allocate budget. SMEs tend to not have excessive resources, and avoiding unnecessary spendings helps relieve the financial stress on the company.

3. Flexible Budgeting

To create a budget according to flexible budgeting means to pre-leave rooms for flexibility.

This can be allocating extra, unnecessary budget to compensate for shifts in market trends, revenue, or financial status.

This method takes unexpected costs into account before the project begins. However, being flexible means having an excessive amount of resources, which not every company has under their inventory.

Types of Costs in a Budget Plan

To properly formulate a budget plan, the management role must understand the different types of costs. This helps the business perform cost accounting more efficiently. Sorting out reducible costs and necessary costs assist business owners make informed decisions as well.

Direct Costs

Direct costs are the cost that the business’ products directly produce. For example, a phone manufacturer’s direct costs would include the raw materials and the workers’ salaries. Direct cost is the only type of cost that doesn't count towards "overhead expenses."

These costs are unavoidable and are necessary in the process of making profit.

Indirect Costs

Also known as operating expenses, indirect costs are difficult or impossible to ascribe to a single source. Take the same phone manufacturer for example, the electricity for the machines to operate is an indirect cost. Most indirect costs fall under the category of "overhead costs."

Indirect costs, like direct costs as well, are mostly unavoidable.

Fixed Costs

Fixed costs, as per its name, are costs that don’t shift in the short term. One other characteristic of fixed costs is that it doesn’t change with the amount of production.

If the phone manufacturer rented its factory, the rent of the factory would count as a fixed cost. The expense doesn’t change with the amount of production, and doesn’t shift in the short term.

Variable Costs

Variable costs, or variable expenses, are the opposite of fixed costs: it shifts, usually with the amount of production. The costs that come with the phone manufacturer transporting the product to the retailers counts as variable costs. If the manufacturer plans to sell more phones this year, the variable cost of transporting the product would increase.

Budgeting Tool: Cost Control Forms

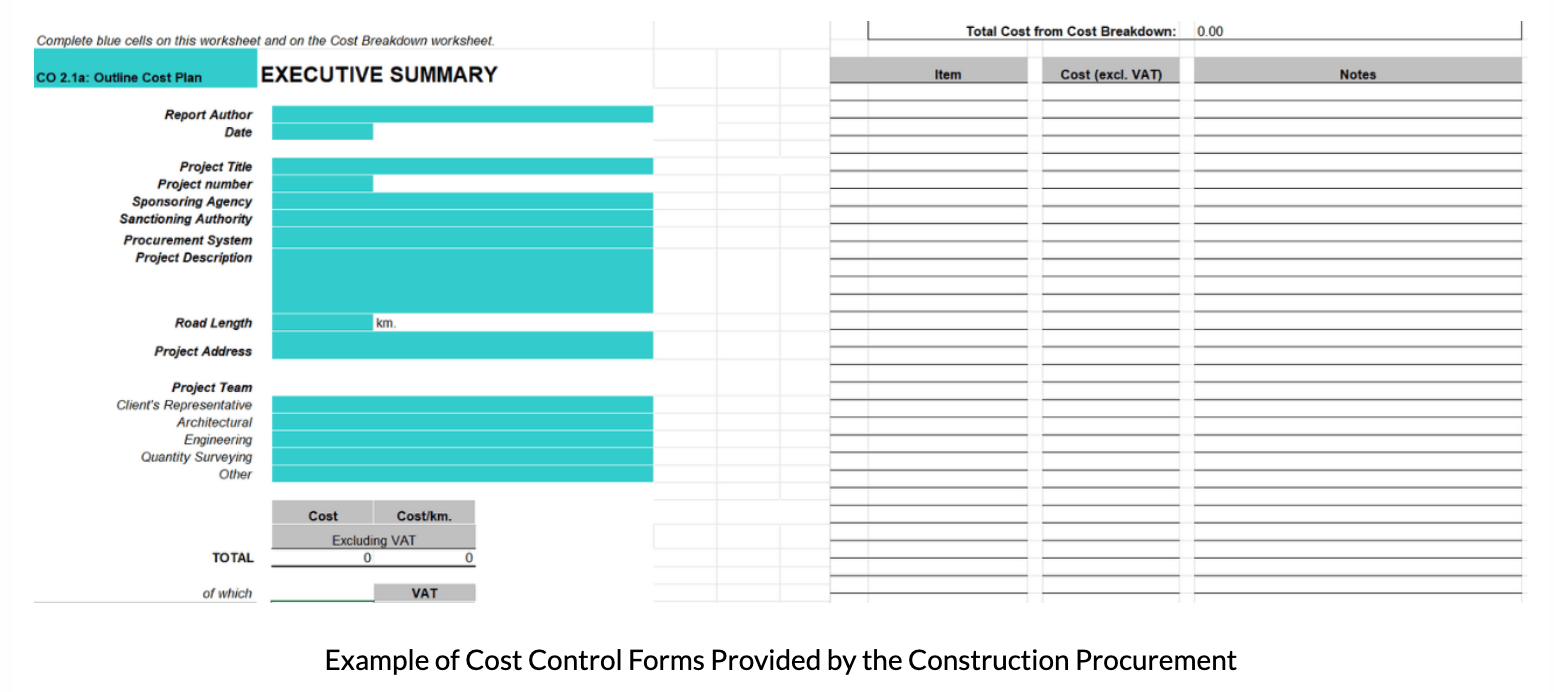

A budget plan shouldn't be living in a contractor's mind, but written out as a document for the team to inspect. One of the many ways to reify a budget plan is through a cost control form.

While no correct way exists to compose a cost control form, businesses have found certain templates useful.

The Construction Procurement, a part of the Irish Office of Government Procurement, has resources for companies. They provide costing templates for building works and civil engineering works, and tutorials on how to utilize them. Construction companies may find these resources helpful in keeping track of business expenses and budgets. On the other hand, private corporations like Smartsheet also provide project cost templates.

Having a plan is great, but an actual form is always better at preventing cost overruns than verbal agreements.

Example of Cost Control Forms Provided by the Construction Procurement

Variance Analysis

Other than an elaborated budget plan, a company should perform variance analysis regularly.

As budget plans involve so many different factors, budgets usually end up inaccurate from deviation. Differences in the budget and actual spending can be fatal to companies. Companies need to be able to spot budget differences whenever it is present.

This is where variance analysis comes into play.

A variance analysis is for pinpointing the scale and reason of the deviation. To perform a variance analysis, financial professionals inspect revenue and expense entries to identify differences in expected budget and actual budget.

Variance analysis not only helps companies identify budget inaccuracies, but also allows management to monitor performance.

Conclusion

A business itself and business assets are investments no different. Companies should weigh every spending based on their potential return. For a business to flourish, management must take careful consideration of business expenses for the return to be worthwhile.

Through proper budgeting, companies can better observe their financial status. Getting ahold of financial information like this allows businesses to make reasonable decisions and increase profit.

Strategic budgeting is key to scaling your business. For tips on growing your contracting business, visit Mastering Growth: Tips for Contractors Looking to Grow Their Business.